Do you currently have an effective drip system to cultivate prospects and turn them into clients?

The following story is not about financial services, but still extremely relevant.

Car Buying Fail

I knew that I needed a new SUV. My old one was getting a little long in the tooth and the mounting deferred maintenance would be costly. I had convinced myself it was time to pull the trigger. Like any rational consumer I went to my trusty computer to study my options. I even went to a handful of dealerships to take in that new car smell.

Fourteen (14!) months later I was the proud owner of a new SUV. So… I knew that I needed a new automobile but why did it take me so long to make it happen?

I will discuss my obvious procrastination in a few minutes, but first I want to point out the incredible mistakes that were made along my 14-month journey.

These tragic mistakes weren't made by me, these atrocities were committed by the several car dealerships that I visited. At each visit it was the same movie. I walk in the door and I am bum-rushed by unrelenting salespeople. Before taking a test drive they photo copy my license and take down personal information. Upon arriving back at the dealership, the hard sell starts. As the dance continues the salesperson comes to the realization that I am not going to help him meet his quota today and he politely dismisses me so that he can move onto his next mark.

Game over, I never heard another word from the car salesman or the dealership.

This wasn't an isolated experience, it happened at every single dealership that I graced with my presence. The travesty is that if someone had continued to stay in my face by calling, emailing, sending letters, staying top of my mind, I probably would have bought from them. As it stands, no one really differentiated themselves.

No one earned my business.

As sad as my car story is, I see that exact same fatal error being committed daily by the average financial advisor.

Financial Advisor Fail

This is how it usually goes: They visit with a prospect, get to know them, analyze their investments, maybe even produce a financial plan… and then when the prospect doesn't sign on the dotted line, the advisor forgets that the prospect exists.

To further understand the gravity of this mistake, let's look at the psychology of consumer decision making behavior.

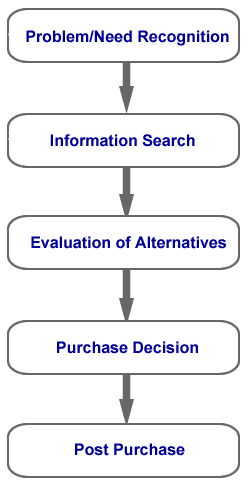

The consumer will take a journey across five distinct phases.

In my case, I clearly went through the first three phases of the buying process. I recognized that I needed a new SUV. I scoured the internet for information. I then visited several dealerships to evaluate my alternatives.

Yet I didn't buy.

I procrastinated because the pain of going through the car buying process was greater than the pain I realized by driving a less than stellar ride; UNTIL IT WASN'T. For me that day came fourteen months later.

The same is true for your prospects. Once you have figured out your prospects true pain points and come up with a solution to solve their financial problem, it now just comes down to timing.

Just because you are ready to sell doesn't mean your prospect is ready to buy.

Drip, drip, drip and keep dripping until your prospect becomes your client.

Maintain Customer Relationships

Get a good customer relationship management system (CRM) and use it religiously. Send relevant information. Call with ideas. Do whatever you can to differentiate yourself and stay top of mind so that when the day comes that your prospect is ready to pull the trigger, you are the first person that enters their gray matter.

If you don't you are just giving away potential new clients and burning time, effort and money.

If you skipped to the end, here’s a summary:

· Learn from the techniques used by big business to scale and achieve massive and sustainable growth.

· Start treating your financial advisory practice like a business.

· Create a plan to continuously get your name and content in front of the people that you serve, and your business will prosper.