What percentage of your day do you spend doing

prospect or client facing activities?

What percentage of your day do you spend doing prospect or client facing activities?

All too often I see financial advisors work too hard and come away exhausted and still not find the results that they are looking for.

The truth is that we only get paid really well to do two things, create relationships and deepen relationships. Almost EVERYTHING else that we do is gross underemployment.

Outsource your way to success

Imagine that you pick up your phone to make a doctor appointment and on the other end of the line is your doctor greeting you with a hello. Then when you arrive at her office she promptly hands you all the paperwork and insurance forms. She proceeds to photo copy your insurance card and then walks you back to the exam room. She then starts the exam by taking your weight, temperature, blood pressure and documenting your reason for today's visit. After receiving professional advice and treatment your doctor walks you back to the front counter, takes your payment and schedules your follow up appointment.

I can't imagine that this doc will stay in business. The reality is that doctors are the kings of outsourcing. They have someone else doing all the things mentioned above except providing professional advice and treatment.

By outsourcing everything else they can run several exam rooms at the same time, seeing multitudes more patients and make more money.

Why do so many financial advisors think that they get paid to manage money, create financial plans, do paperwork, etc.?

I hate to break it to you, but these tasks are underutilizing your skills. These tasks will not create the trust and loyalty from your clients that is so crucial to maximizing the client/advisor relationship. Without that trust how do you expect your client to take your advice through thick and thin?

Income vs Time Spent

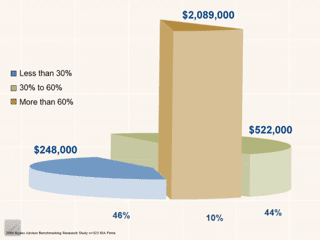

Rydex published a wonderful study regarding financial advisors’ income levels based on the percentage of their time that they spent on prospect or client facing activities.

They found that advisors that spent more than 60% of their time creating relationships and deepening relationships made 8.42 time more money than their counterparts that spent 30% or less of their day on client facing activities.

That is huge!!! This is so important, that I am going to repeat myself. 8.42 TIMES more money than the average financial advisor.

Please, please, please, invest in technology, systems, people, outsource companies, etc. and stop doing the things that won't make you money.

To wrap it up:

· Learn from the techniques used by your doctor to scale and achieve massive and sustainable growth.

· Start treating your financial advisory practice like a business.

· Stop wasting your time doing $10, $20, or even $30 an hour work. You get paid really well to create relationships and deepen relationships—now go do it and your business will explode.